The Greatest Guide To Home Improvement Financing

Table of ContentsHome Improvement Financing Things To Know Before You BuyHome Improvement Financing Things To Know Before You Buy

Putting expensive house improvement and also repair costs on a credit report memory card is certainly not the greatest selection if you understand it will take you many months or even years to pay out those in full. Pros May be actually unprotected (no danger of shedding your residence)Depending upon the finance company as well as your credit rating score, enthusiasm fees might be greater than home capital fundings Quick and also easy application process; swiftly accessibility to cash, No tax obligation reduction advantages Generally no early repayment penalties & might possess much better APRs than average visa or mastercard May feature a source expense (this is actually normally less than closing costs on a property capital lending or product line of credit report) To find the most effective residence enhancement financing, it pays out to look around - home improvement financing.It relies on your financial condition as well as the sort of home repair service you useful link intend to do. If you choose not to utilize your residential or commercial property as collateral, unsafe individual fundings may be the most click to read effective type of funding for costly home improvements or large redesign projects. Rather than a prolonged underwriting method (typical along with residence equity finances), the loan provider will definitely look at your credit report score and also credit rating, your earnings, as well as any existing personal debt to identify the loan promotion.

You'll at that point produce monthly settlements with the lifestyle of your car loan. A property capital car loan may be the most convenient means to acquire cash for residence enhancements along with below par credit report.

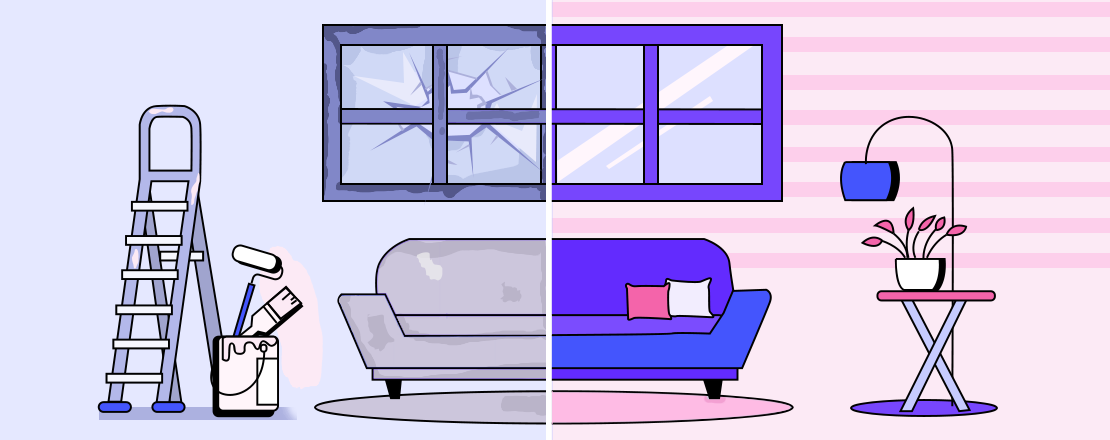

Find the correct property remodeling financing to More Info develop your desire home, As a resident, you have actually very likely experienced an unanticipated concern that was expensive to repair - home improvement financing. Or perhaps you've thought about hiring a local property renovating contractor to remodel your kitchen but chose versus it due to the fact that of the high price.

5 Simple Techniques For Home Improvement Financing